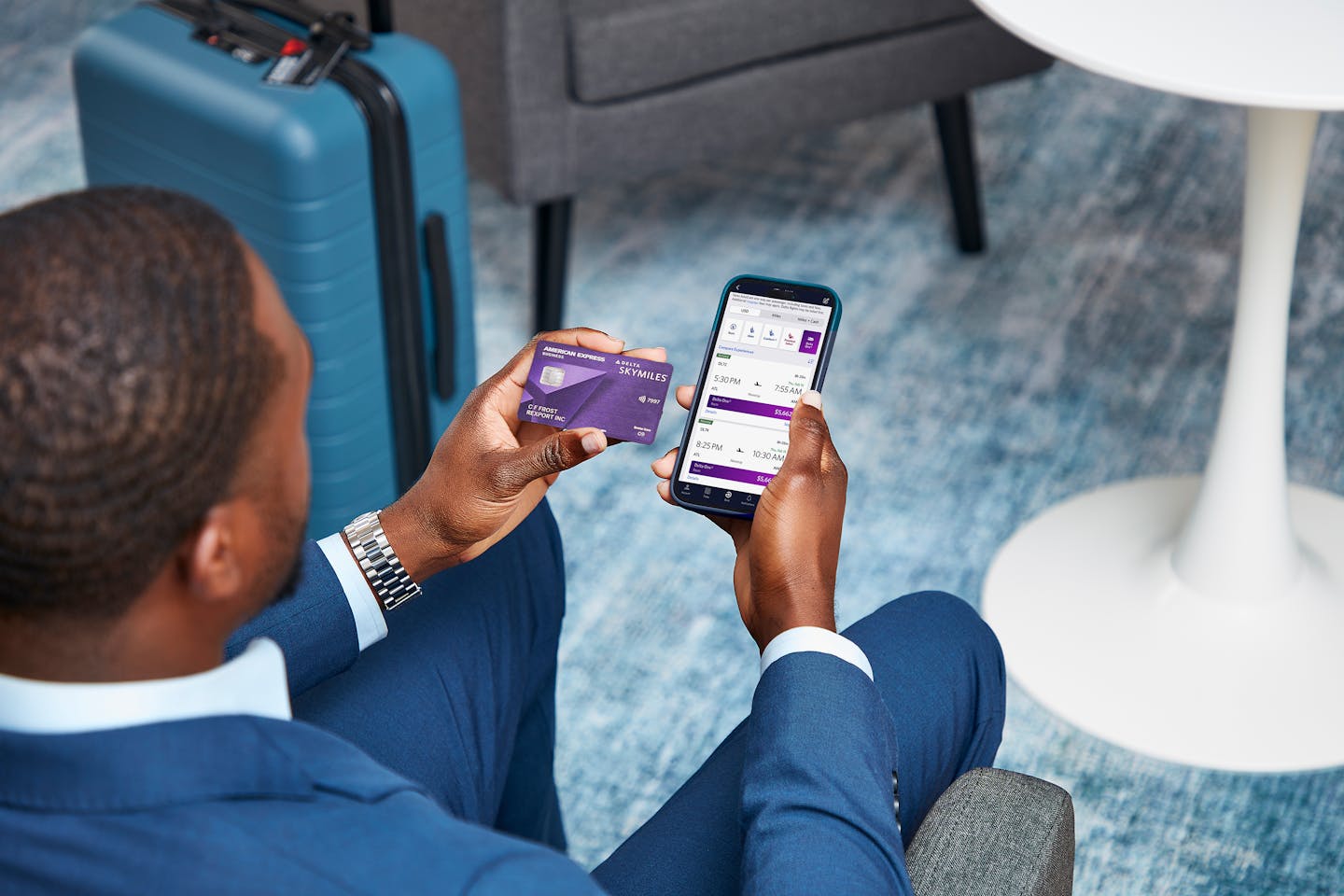

Just when we thought everything had been said about Delta Air Lines' controversial 2023 changes to its loyalty program, the airline has turned around and revamped its SkyMiles American Express cards — again.

This time, the popular credit cards are getting the dreaded annual fee increase.

On or after May 1, the Delta SkyMiles Gold Amex's annual fee will jump from $99 to $150; the SkyMiles Platinum Amex will surge from $250 to $350; and the premium SkyMiles Reserve Amex will soar from $550 a year to an eye-watering $650. Captain, release the oxygen masks!

It's not all bad. In exchange for the new annual fees, all three cards will come with all-new travel and dining benefits that could potentially help savvy customers make up for the increases — and then some. (All of the cards will continue to earn SkyMiles on everyday purchases and offer longtime benefits such as your first checked bag for free.)

Of course, the new benefits are designed to make you more reliant on your Delta Amex, and increase your usage of Delta services. The changes arguably turn the SkyMiles credit card ever more into an expensive coupon book. Cardholders who aren't interested in working a little harder to make their Amex worthwhile may be turned off.

So let's break down the new fees and benefits for each card, to help you decide if you'll keep your SkyMiles American Express — or apply for one.

Delta SkyMiles Gold American Express Card

Annual fee increase: From $99 to $150 (after a free first year).

New benefits: The annual Delta flight credit expands from $100 to $200; plus a $100 statement credit for prepaid hotels and vacation rentals through Delta Stays, the airline's Expedia-powered booking site.

Comment: The entry-level Gold card has long been a no-brainer value, providing members with a free checked bag for everyone on your reservation (a $30 savings per person, per trip). The added $51 on the annual fee may change that calculation.

If you were already spending $10,000 a year on the Gold, the expanded $200 flight credit alone would cover the new annual fee and more. But if you aren't charging 10 grand a year, you get no flight credit. You'll have to determine for yourself if the free checked bags and the $100 Delta Stays credit would still cover the $150 annual fee.

If you do decide to drop the Gold, don't cancel outright. Keep your line of credit by downgrading to the no-annual-fee Delta SkyMiles Blue American Express, which earns double miles at restaurants with few other benefits.

Delta SkyMiles Platinum American Express Card

Annual fee increase: From $250 to $350.

New benefits: An enhanced annual companion certificate; $120 credit on the restaurant-reservation service Resy; $120 credit on rideshare purchases; $150 Delta Stays credit; complimentary Hertz Five Star Status; eligibility for the complimentary upgrade list.

Comment: Platinum cardholders like myself already had our Sky Club lounge access taken away this year. But the big perk of the Platinum is the annual Main Cabin companion certificate, with which your companion flies free (except for taxes) to destinations in the Lower 48. Now, that certificate will potentially expand greatly to include Hawaii, Alaska, Mexico, the Caribbean and Central America. Some users have reported that the companion certificate is hard to use. I find it fun, but have admittedly let one or two expire in the past. I'm looking forward to trying it with the broader range of destinations.

The other eye-opening new benefit: Platinum cardholders without Medallion status will be added to the complimentary upgrade list on flights with an "eligible ticket" (i.e., not Basic Economy). However, Platinum users will sit firmly at the bottom of the list, after Medallion members and Reserve cardholders. If you've ever seen the long upgrade list on the screen at the gates of MSP, you know it's unlikely that your name will often make it to the top, except perhaps on non-hub flights.

Failing all of that, the $390 in new statement credits — $120 on restaurants with Resy, $120 on rideshares (i.e. Uber and Lyft) and $150 on Delta Stays — could help you chip away at the $350 annual fee. But the credits on Resy and rideshares are each limited to $10 per month, so your spending on those services will have to be consistently year-round to get the full benefit.

Delta SkyMiles Reserve American Express Card

Annual fee increase: From $550 to $650.

New benefits: An enhanced annual companion certificate; $240 credit on restaurant purchases with Resy; $200 Delta Stays credit; $120 credit on rideshare purchases; two additional Sky Club guest passes; complimentary Hertz President's Circle Status.

Comment: The lofty Reserve card is the choice for Delta loyalists interested in Medallion status and Sky Club access — with the annual fee to match. The new benefits are similar to those for the Platinum card, but with higher dollar figures.

The Reserve's companion certificate will expand from the contiguous 48 states to Alaska, Hawaii, Mexico, the Caribbean and Central America. First Cass, Comfort Plus and Main Cabin fares are included. Again, some have found the companion certificate useful, and some haven't, but Reserve members can book a broader range of fare classes for their free companion ticket.

For Hertz rental car loyalists, President's Circle benefits include free upgrades, guaranteed car availability and bonus points.

But it's the whopping $560 in new statement credits that should help you wipe out the additional $100 for the annual fee, if not much of the remainder. You can subtract $20 a month ($240 a year) from your restaurant tab with the Resy credit, plus $10 a month ($120 a year) on Uber and Lyft with the rideshare credit. The $200 credit on Delta Stays hotels and vacation rentals can be taken all at once. These higher amounts should make it easy for Reserve cardholders to ignore the new annual fee, with a little planning and effort.

Then again, if you were already paying $550 a year for the Reserve, you might not even notice.